A federal judge gives the green light for the CVS-Aetna merger, which has the potential to usher in a new era of patient-centric healthcare.

The last obstacle to CVS’s attempted acquisition of health insurance provider Aetna was removed earlier this month, when a federal judge ruled that the $69 billion merger is “in the public interest.”

Though CVS formally closed on the acquisition of Aetna in November 2018 with government approval, concerns that the merger could potentially harm customers led to Judge Richard Leon of the District of Columbia asking for quarterly reports from the combined company. Leon could have potentially blocked the deal based on these reports, but his ruling gives the green light to a massive merger that has the potential to revolutionize the healthcare industry.

CVS issued a short statement in response to the ruling: “CVS Health and Aetna have been one company since November 2018, and today’s action by the district court makes that 100 percent clear. We remain focused on transforming the consumer healthcare experience in America.”

What This Means for the Future of Healthcare

The CVS-Aetna merger has the potential to shake up traditional healthcare models in favor of a more dynamic and patient-focused approach. The benefits of the partnership remain to be seen, but as CVS adapts to meet patients’ evolving needs, the company could be blazing a trail for the rest of the industry to follow.

Based on the success of three pilot sites in the Houston area, CVS plans to open 1,500 HealthHUBs — which expand on the health services already offered by its 1,100 MinuteClinics — by the end of 2021. Where MinuteClinics feature one or two exam rooms and provide a range of basic services like immunizations and cold treatments, HealthHUBS will offer a greater range of routine services that can be used to manage chronic diseases or conditions, including blood and sleep apnea tests. According to CVS, these HealthHubs are designed to benefit the large number of MinuteClinics patients who don’t have primary-care physicians.

The potential effect of these initiatives is two-fold. First, CVS’s HealthHUBs seem poised to fill the role of primary-care providers for millions of Americans with little or minimal insurance coverage. The CVS-Aetna merger opens further opportunities for integration, as well, which could potentially pair personalized insurance information with patient care at every step of the process. From clinic intake to claims, patients and healthcare providers would be able to access all relevant information from the same digital portal.

Secondly, by revamping its business model to favor personalized care, CVS is positioning itself as a major player within the market. As players like Amazon continue to expand their roles in healthcare, CVS is joining the ranks of patient-centric providers. The company’s new HealthHUB model and merger with Aetna both indicate that CVS’ hands-off, self-service approach is a thing of the past.

How PCPs Can Adopt Patient-Centric Care

While the CVS-Aetna merger has many potential benefits, it also may pose challenges for smaller medical practices. Primary care physicians and other healthcare providers may struggle to compete with larger entities like CVS that have greater resources. Fortunately, there are steps PCPs can take to ensure they meet patients’ expectations in terms of convenience and personalization.

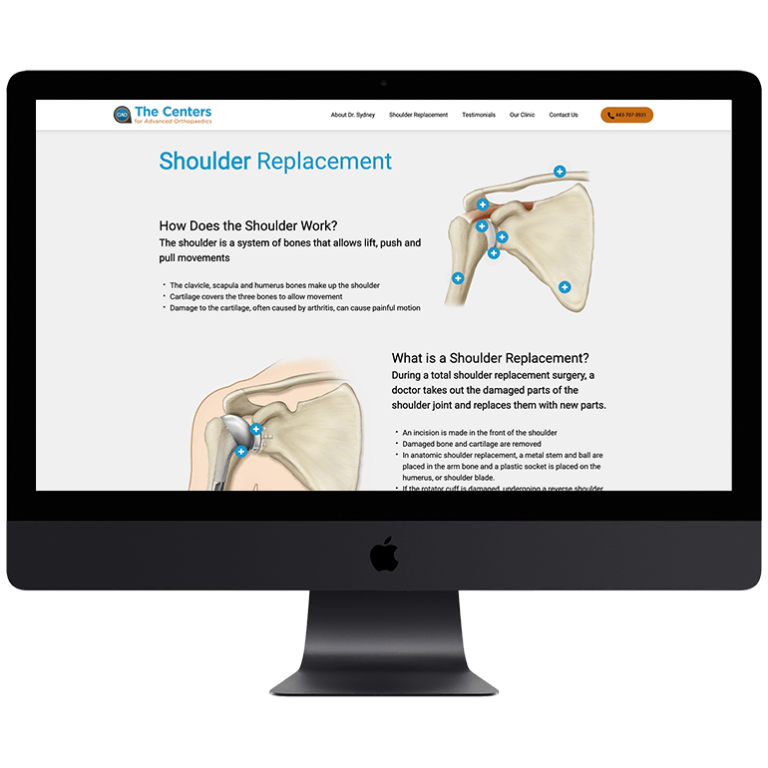

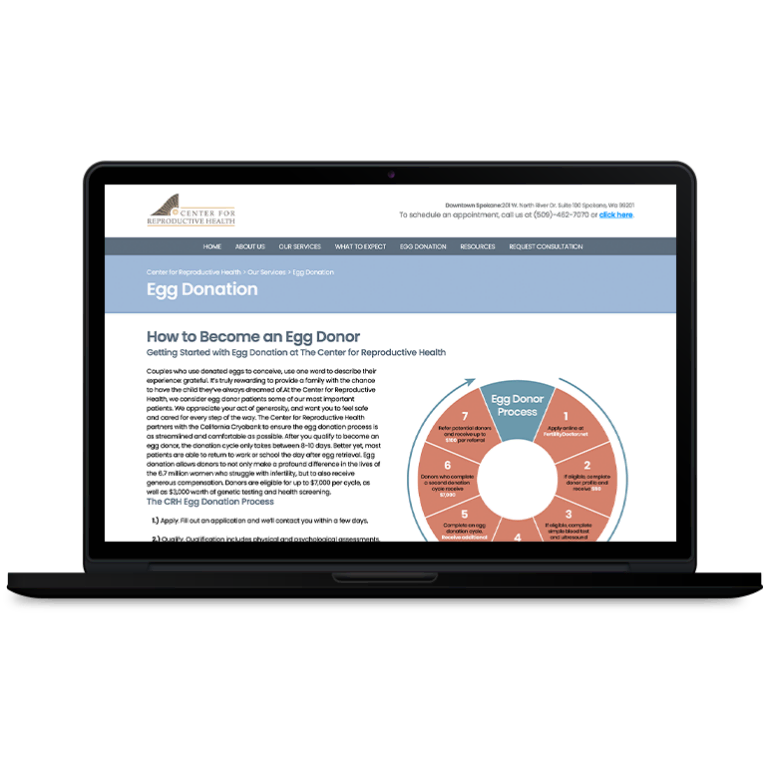

Embracing digital technology is often the best way for smaller healthcare facilities to stay relevant. Leaning into a strong SEO practice, making sure their website is intuitive and easy to navigate, and developing a distinctive presence on social media are all excellent ways for primary care providers to find new patients. Other features, like making it easy to book appointments online via easy-to-use web portals, will only emphasize providers’ commitment to patient-centered care and treatment. Each of these choices — especially when paired with compassionate, in-person care — can help independent patient care facilities remain competitive.

Smart Design Creates New Patient Opportunities

Smart Design Creates New Patient Opportunities