Programmatic ad spend is slowing more quickly than anticipated, but it’s far from obsolete.

Programmatic has been the hottest trend in digital advertising for a few years now, but growth is slowing — and it’s slowing more quickly than previously anticipated. Last year, Zenith Media predicted that 67% of ad spend would be programmatic in 2019, but early numbers indicate that spend will realistically only make up 62 to 65% of ad spend.

That number represents a growth of under 11 percent, comfortably below previous predictions. This slowing can be attributed to a number of factors, but the EU’s General Data Protection Regulation (GDPR) is likely the most notable. The GDPR has rendered some data used for programmatic transactions unavailable, which has made advertisers reluctant to channel funds into programmatic.

In addition, marketers appear to be funneling spend into technological infrastructure and data rather than programmatic ads themselves. Here’s what these changes mean for medical marketers in 2019, and what healthcare organizations need to know about the changing trends in programmatic.

1. Efficiency is increasing.

As companies invest in AI and machine learning technology and new infrastructure, they’ll inevitably get better at identifying which consumers need to hear from them and when. That will ensure that every ad spend dollar goes further than ever before. If your healthcare organization hasn’t had a marketing infrastructure revamp in a while, now is a good time to look into new digital partners — healthcare providers who don’t may find themselves left in the dust.

2. The GDPR slowdown won’t last.

Companies and ad platforms are already adjusting to the new GDPR regulations, ensuring that they’re compliant with new consumer privacy rules. As ad platforms prove themselves to be in compliance with the law and companies begin to trust them again, programmatic spend will recover. It’s already shown some signs of growth following the initial slowdown. However, spend likely won’t be as high as before, as these changes will accompany companies’ new infrastructure and their subsequent increased efficiency.

3. The slowdown is US-exclusive.

As the US market for programmatic ads becomes saturated, many companies are looking to new, diversified ways of allocating spend to reach consumers more effectively. However, as programmatic technology pushes outside of the US borders, expect spend to grow globally. Currently, the US is the largest programmatic market, but distant second China has predicted growth of 74% in the next two years. Australia, India, Hong Kong, and New Zealand are all predicted to see significant growth as well.

While programmatic is still critical for success, take advantage of this strategic time to begin allocating spend into other areas — including investments in infrastructure. When ad platforms begin to catch up to GDPR regulations, medical marketers will want and need the technology to help them ensure that their ad spend is as efficient as possible.

It’s likely that your programmatic spend will never return to its previous level of growth — but that’s a good thing. Increased spending efficiency and even more innovative forms of advertising are on the horizon.

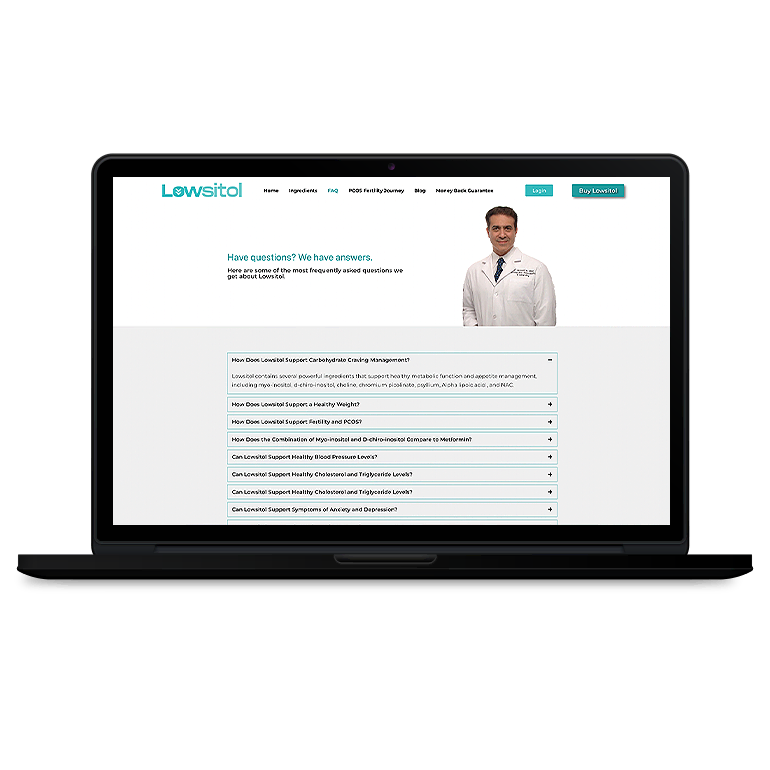

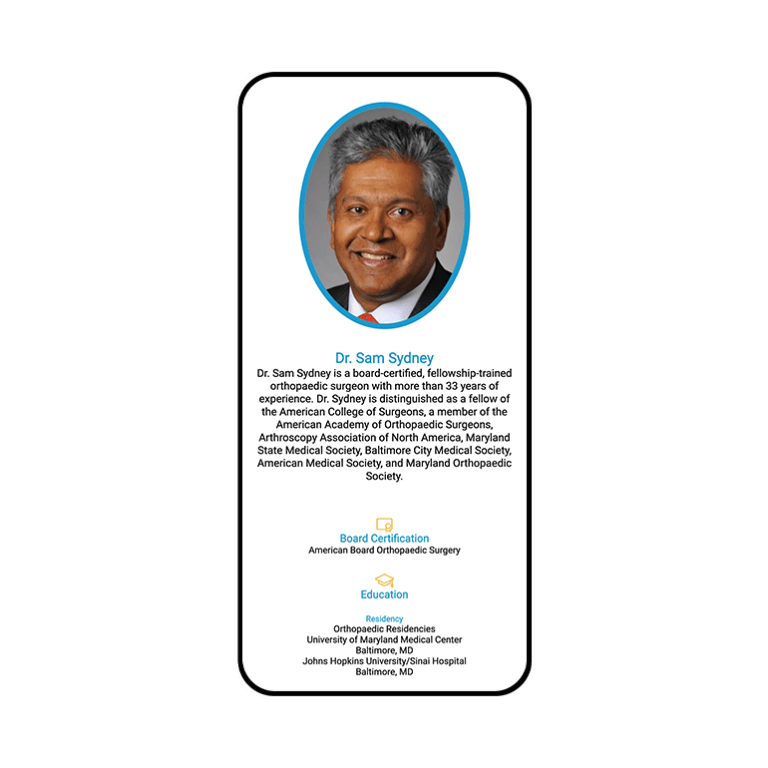

Smart Design Creates New Patient Opportunities

Smart Design Creates New Patient Opportunities